If you’re targeting multigen families, be specific and stand out.

As immense generational wealth transfers generate opportunities for advisors, marketing within this niche will become increasingly competitive in the coming years.

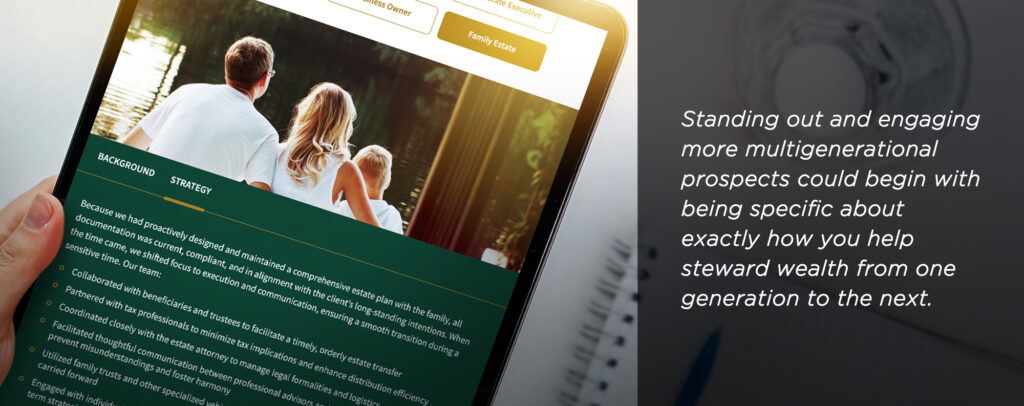

Still, few advisory firms are adequately communicating the value they provide for this type of client. Standing out and engaging more multigenerational prospects could begin with being specific about exactly how you help steward wealth from one generation to the next.

Because the role advisors play is about much more than just identifying a few tax strategies. For those who really cater to wealthy families, it can also involve collaborating with estate lawyers to draft up detailed trust documents that help prevent estate disagreements; it can require IAs to communicate with multiple generations to understand a family’s dynamics, relationships and priorities; and it can entail sophisticated strategies to meet philanthropic goals through living legacies and estate plans.

While CPAs and estate attorneys are indispensable to the process of planning and transferring family wealth, financial advisors are often in a unique position to coordinate it all. And this can be just as valuable as the financial expertise you bring to the table.

It’s important to convey this value through your core brand, but what could make the difference is thought leadership. Blog articles on niche estate topics, case studies on the relationship management side of wealth transfers, and videos demonstrating your depth of expertise—it all enables you to share more detail, which means:

- If someone in your target market searches a specific estate planning question online, your site could appear in the results.

- Lots of IAs claim to offer multigenerational wealth guidance, but if you show some of the granular detail, you could be seen as the better choice.

- Many firms are not sharing this kind of content (even if they’re providing this level of service), so being specific about what you do can help you position yourself as a go-to specialist.

If you’re looking to position your practice for wealthy multigenerational families, get in touch with us for more ideas.