How to Specialize Without Limiting Your Practice

A strong specialization is far from limiting. Still, some advisors are hesitant to present themselves as specialists for fear of alienating segments of their client base.

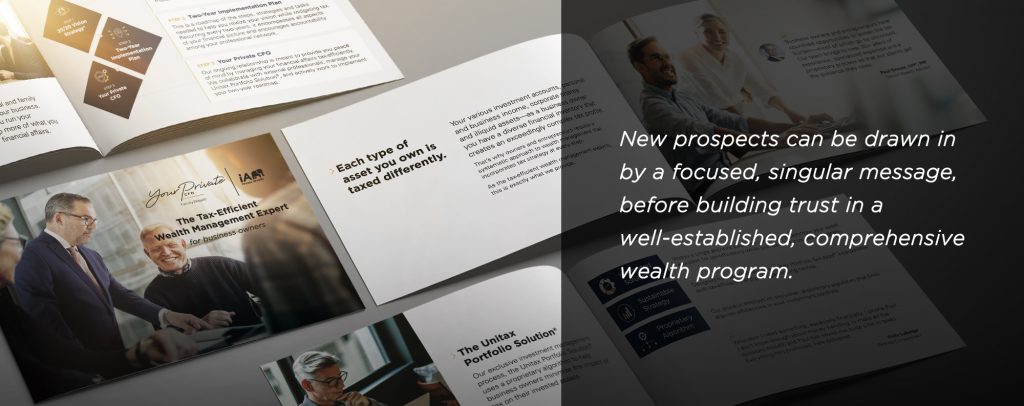

For this Ottawa-based advisory, Your Private CFO Family Wealth, the task ahead was to present something specific and relevant enough to catch the attention of successful business owners, without overlooking the full depth and breadth of the team’s service capabilities.

Their introductory brochure package, we decided, would be focused on the lead advisor’s specialty as a “tax-efficient wealth management expert,” helping business owners keep more of what they earn. With the rare legal approval of the term “expert” and a proprietary tax-efficient investment process, the value proposition for this target market was exceptionally clear.

Their second branded touch point, which would facilitate prospect meetings and follow-up conversations, was to complement the introductory kit by outlining the range of services offered by the team as a whole. With the investment process already covered, this piece would communicate that the firm’s approach would help clients mitigate tax not only through investment strategy, but also in their cash flow, retirement and succession plans, family wealth, and estate transfers.

Together, these brand pieces will help ensure the two core components of the firm’s identity—as a niche expert and a personal CFO—will be seen as complementary, not conflicting. New prospects can be drawn in by a focused, singular message, before building trust in a well-established, comprehensive wealth program.

What’s important is building an all-encompassing wealth management program without losing what makes you different. For many full-service advisory firms, this means conveying your specialized expertise as the distinguishing feature of a one-stop-shop service.