Top 5 Lead Conversion Strategies Our Clients Employ

Advisors are often looking for ways to build trust with prospects between the time they’re first introduced and the moment they decide to become clients.

So from all the recent lead conversion projects we’ve launched, we’ve taken the top five strategies employed by successful teams across North America.

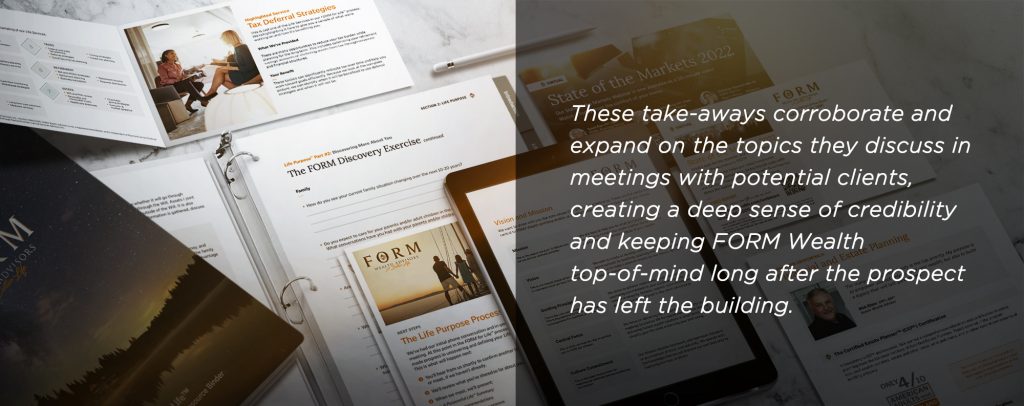

- FORM Wealth never leaves prospects empty-handed.

You can and should sit down with potential clients to explain what it is you do and what makes you well-positioned to serve their particular needs. But when they get up to leave, they should have more than just words to take with them.

FORM Wealth knows that if it’s tangible, it’s real. Whenever they generate a new lead for one of their three Wisconsin branches, they offer material that introduces the firm and the capabilities of their dynamic team. As the relationship develops, they have specialized collateral outlining their biggest differentiators, such as their investment management process and their impressive educational qualifications.

These take-aways corroborate and expand on the topics they discuss in meetings with potential clients, creating a deep sense of credibility and keeping FORM Wealth top-of-mind long after the prospect has left the building.

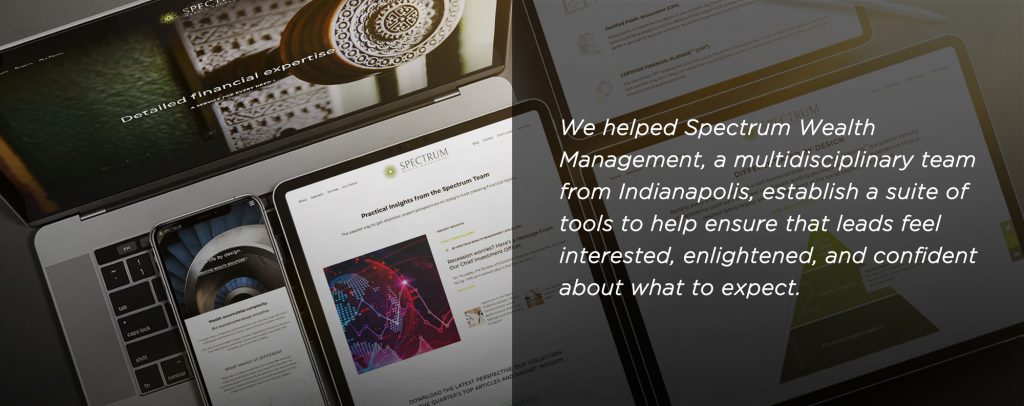

- Spectrum Wealth Management anticipates questions.

If a lead has just been introduced to you, they will have high-level questions that require high-level answers. If they’ve gotten to know you, they may need to see the minutia in order to be comfortable moving forward. Every stage of lead development requires you to peel back another layer and show the potential client a new dimension of who you are.

We helped Spectrum Wealth Management, a multidisciplinary team from Indianapolis, establish a suite of tools to help ensure that leads feel interested, enlightened, and confident about what to expect. This includes a well-organized website, a broad-strokes primer and a welcome kit with a resource overview and next steps—all arranged and presented to provide the right information at the right time as they build trust with prospects.

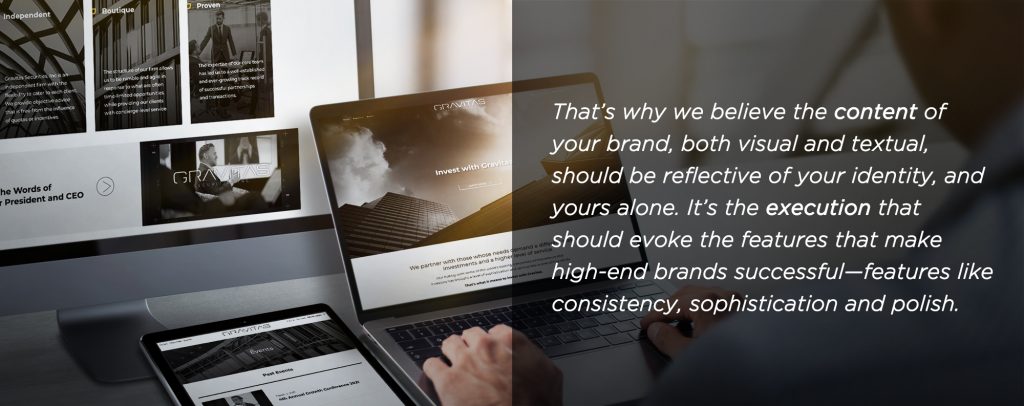

- Gravitas Securities projects a high-end feel.

When you want to be seen in the same light as those at the pinnacle of the industry, it can be tempting to borrow the common phrases and themes you associate with them. In fact, this may be the reason there is so much overlap and repetition in the way financial institutions present themselves to potential clients. The risk to you is that, in an attempt to stand out, you can easily end up blending in.

That’s why we believe the content of your brand, both visual and textual, should be reflective of your identity, and yours alone. It’s the execution that should evoke the features that make high-end brands successful—features like consistency, sophistication and polish.

This is precisely what we helped Gravitas Securities achieve. With offices in Toronto and Vancouver, this growing firm needed a polished website that would convey their credibility as well as their unique value. The site emulates high-end brands while communicating their singular message.

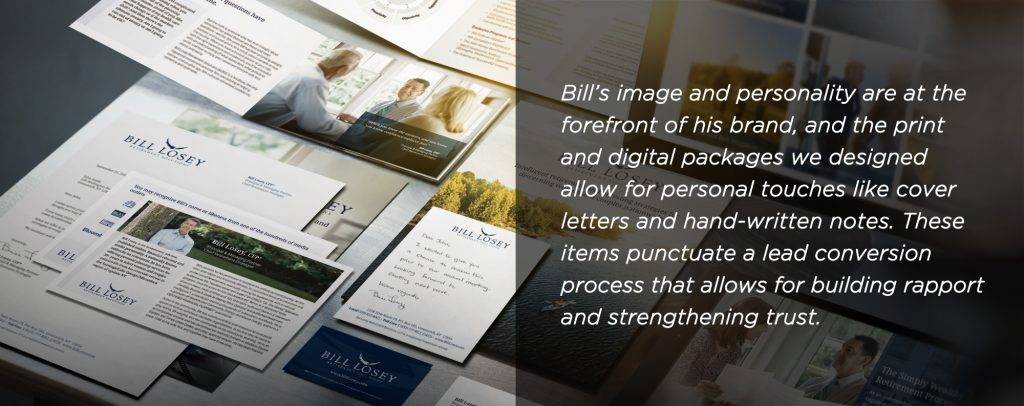

- Bill Losey keeps it personal.

We all know that no matter how professional you are, at a certain point there has to be a good personal fit.

Bill Losey (“Bill Losey Retirement Solutions”) is one of the many advisors who are comfortable with this aspect of lead conversion. So it was important to maintain the personal dimension even as we built out a suite of polished materials designed for lead introduction and relationship-building in the COVID/post-COVID era.

Bill’s image and personality are at the forefront of his brand, and the print and digital packages we designed allow for personal touches like cover letters and hand-written notes. These items punctuate a lead conversion process that allows for building rapport and strengthening trust.

- Zacks Investment Management has a process.

This brings us to our last strategy: the importance of having a process in the first place.

Zacks Investment Management is a Chicago-based firm with both retail and wholesale representatives across the United States. They needed to be able to draw from the same pool of brand resources and strategies, with repeatable steps that they could optimize over time.

With both digital and print collateral, the diverse team now has functional, brand-consistent materials for each stage of the lead conversion process. This includes firm overviews, product and service literature, and customizable investor proposal presentations.

So if your current process is generally informal, consider introducing some structure, and keep in mind these five strategies as you build it out.