Everyone wants to stand apart—but from whom?

Most advisors and firms have at least a general idea of whom they’re targeting. They know they’d like to reach more high-net-worth families, become more entrenched with entrepreneurs or capture more multigenerational wealth. What gets less attention is whom they’re competing against.

How you define yourself in relation to other providers is a crucial part of your positioning, and it can change the entire trajectory of your brand and growth strategies.

Ask yourself if you want to stand apart from:

Average advisors. Are you looking to take your practice to the next level? Avoid the canned phrases and basic templates, and articulate more sophisticated services and value-adds within a polished outward brand.

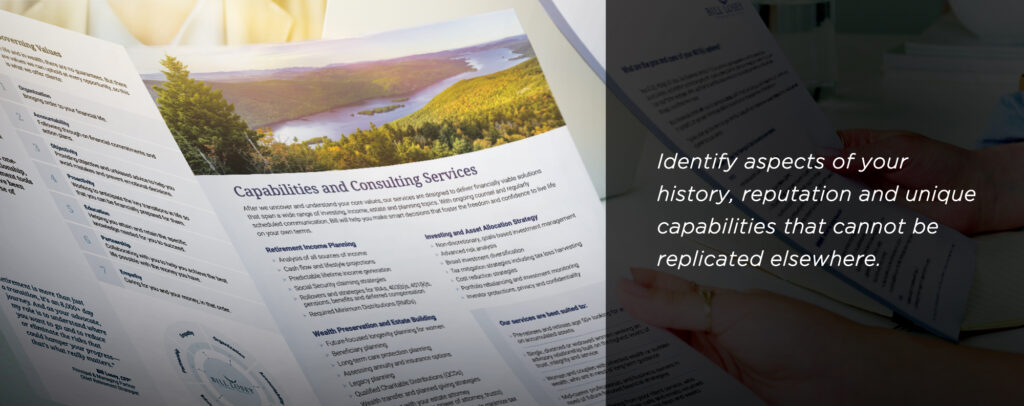

Other leading advisors. Is exceptional service and expertise table stakes for the kinds of individuals you’re looking to attract? Identify aspects of your history, reputation and unique capabilities that cannot be replicated elsewhere.

Generalists. Do you have more expertise in areas that matter to your target market? Present yourself as a specialist and be clear about what you do differently.

Robo-advisors and online solutions. Are members of your target market likely to be cost-sensitive or skeptical of traditional financial services? Spell out your personalized, hands-on process and the concrete advantages it creates, especially when it comes to wealth creation and personal guidance.

Other bank-affiliated teams. Are there networking and COI opportunities within your bank or institution that you want to capture? Make sure that, even at first glance, you have a different look and feel from your peers and, even within the applicable brand and regulatory standards, you define a relevant message.

Independent firms. Do the advantages of the bank environment resonate with your target market? Highlight the resources you have access to and the strength and stability of your affiliations.

Non-independent firms. Do banks and major financial institutions represent the conventional choice for the people you’re trying to reach? Emphasize the flexibility, objectivity and transparency associated with independence, and how you use those attributes to the benefit of your clients.

It’s certainly possible that you’re competing against more than one of these groups, but generally being mindful of whom you need to stand apart from will give direction to your growth and marketing strategies. It will help you determine which attributes are relevant, which stories will resonate, and what will capture the attention of the people you want to reach.