Who are you with?

When a new client decides to work with you, they’ve also decided to place their trust and their assets in the hands of a bank, custodian or broker-dealer. So regardless of whom you’re affiliated with and in what capacity, that relationship needs to be spelled out for every prospect.

Many advisors and firms struggle with where and how to do this. Here’s what we recommend:

Banks and Major Institutions

If you’ve successfully built a singular brand under the umbrella of a major institution, you’re likely still required to present their name and logo in equal prominence to your own. This prevents any confusion from the outset, but it leaves you with the responsibility of explaining the advantages of being aligned with this institution.

To this end, it’s often useful to share basic facts like history, assets under administration, industry reputation and recognition, emphasizing their influence on the national or global scale. Then you can highlight the resources available to your clients by virtue of this affiliation—like the private banking, insurance, philanthropy or business services that you’re able to integrate into your advisory process.

Independents and Hybrids

You’ll want to introduce your affiliations early, especially if you’re linked with a lesser known entity or if you’re completely independent. In the absence of name or logo recognition, set up the narrative yourself by presenting your independence (or your place in an independent network) as a clear advantage.

Explain how you use the freedom of independence to offer clients greater transparency, flexibility and customization. Then, share some information about any custody and clearing services, and the safety and security they represent. You’ll likely also have to disclose affiliations like IIROC or CIPF, which will only bolster your credibility further.

How and Where

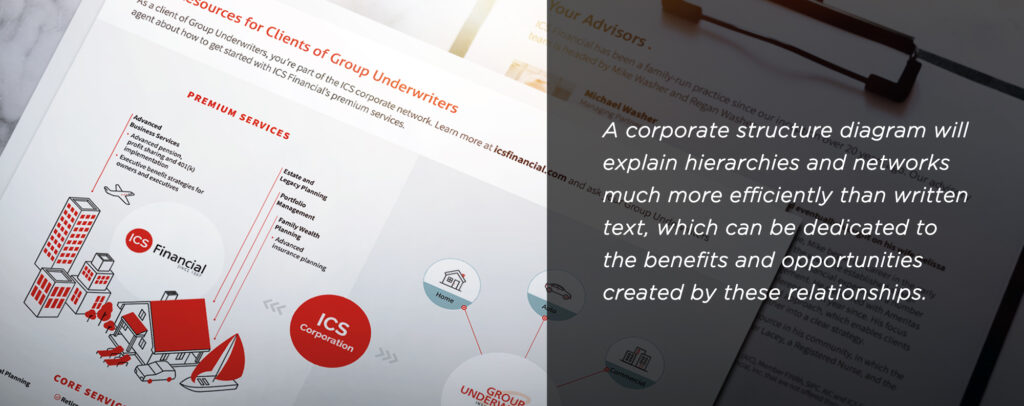

In both cases, visuals as well as words can help tell the story. A corporate structure diagram will explain hierarchies and networks much more efficiently than written text, which can be dedicated to the benefits and opportunities created by these relationships. This approach can also be helpful for existing clients, as another way to reinforce your value.

You can most likely accomplish all of this with a blurb at the end of an introductory piece, an insert in a follow-up package and a section on your website. It’s not the first thing prospects see, but make sure it’s easy to find if they go looking for it.